Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Apple’s Bite

Apple will now let paid subscription apps (think The Economist or meditation app Calm) offer audio content exclusively for their subscribers, a trendy tactic in Podcast Land.

Spotify has a similar idea, but it partners with the subscription service Patreon.

And Apple loves iOS subscription revenue.

In 2020 and 2021, apps with name recognition and organic interest – including Fortnite, Netflix and Spotify – were trying to prod potential subscribers to sign up online, thus circumventing Apple’s 30% fee.

But when Apple saw a new crop of popular apps with credit card connections, it just started doing its own performance marketing for those apps – driving people to subscribe in-app before the developer itself could divert people to the web.

Congratulations to podcasters, I suppose! Your subscription revenue has grown to a point that Apple must have its cut.

To integrate podcast subscriptions, iOS users can simply switch their subscription payments to Apple. Otherwise, listeners must log in each time they open the podcaster’s channel (lol).

Once users subscribe, Apple will offer new paid and organic promotional opportunities, according to the release.

Through The Brand Portal

Roblox is pushing its self-service immersive ad network to more advertisers, aided by the hire of Meta alumna Stephanie Latham as VP of global partnerships, Insider reports.

The immersive ads take two forms: unclickable still images that show up in gameplay (like a billboard in a racing game) and portal ads, which feature a door that zips users to different in-game experiences. Brands such as H&M, Spotify and NASCAR were among the early testers of the immersive ads.

Historically, Roblox hasn’t sold ads. In its earnings from all the way back … *squints* … in February of this year, Roblox said advertising constituted an “insignificant amount” of revenue. But it’s changing its tune now by commissioning brand lift studies, adding third-party measurement partners and growing its agency roster.

The gaming platform joins a crowded space of new ad platforms, including Netflix and Uber. Still, brands are setting up Roblox-specific internal teams as they eye Roblox’s user base, which numbered 66 million daily active users in July.

The New Ad World Underbelly

In the ad industry, people forget that advertising was conceived to distract and divert people.

Want to watch this show? Here’s an ad. Looking for that soda? Here’s this soda.

For retailers, sweeping adoption of retail media networks can create painful and unexpected trade-offs. Walgreens, for instance, is now embroiled in a lawsuit with Cooler Screens, a smart-screen maker that turned fridge and freezer doors into ad space, The Wall Street Journal reports.

Except, it turns out, cooler doors are transparent for a reason. Of course, the technical display doesn’t always match what’s behind the doors. And customers get ticked.

Cooler Screens, the tech vendor, says Walgreens botched the rollout and didn’t deliver on customer data for targeting.

(By the way, that’s the rationale why telco ad tech failed to take off. When new CEOs took over, AT&T and Verizon couldn’t stomach advertising. Similarly, Walgreens’ new CEO wasn’t a fan of Cooler Screens.)

Cooler Screens’ lawsuit says Walgreens’ then-CEO derided their product as making stores like “Vegas.” Walgreens counters that the screens didn’t work – even catching fire (and not in that advertising word-of-mouth kind of way).

But Wait, There’s More!

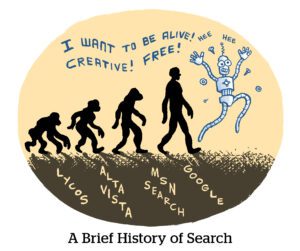

The DOJ’s antitrust battle with Google underlines Big Tech’s preference for secrecy, a growing bugbear for advertisers. [Digiday]

Microsoft CEO Satya Nadella says Google could accelerate its search dominance if it can pay publishers for exclusive rights to make its search AI better than rivals. [Bloomberg]

As generative AI creates new risks for businesses, insurance companies sense an opportunity to cover ways AI could go wrong. [WSJ]

Instacart faces a bearish few months, as analysts expect revenue to miss forecasts. [The Information]

Who wins when telehealth companies push weight loss drugs? [The Verge]

You’re Hired!

W3C names Seth Dobbs its next CEO. [release]

RTB House appoints Michael Lamb as chief commercial officer. [release]

Gabriela Vargas joins Wavemaker as LATAM CEO from Publicis’ Starcom. [release]

Ad platform Equativ hires Emir Teffaha and Marisa Nelson as EVPs. [release]

OMD poaches Amazon exec Suhaila Hobba as US chief media officer. [Ad Age]