Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

In Services To Who?

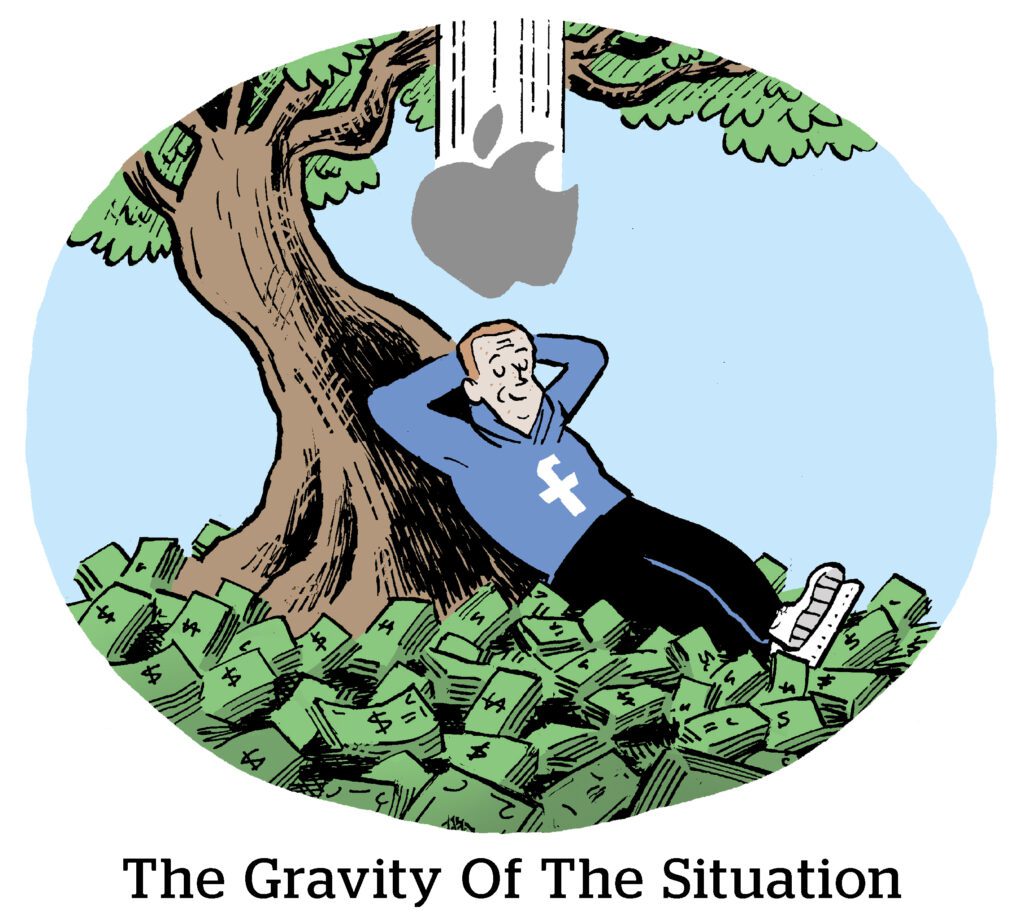

Apple’s Services revenue – made up of its subscription businesses and the triple-tithe fee on iOS developer earnings – is at risk in 2024, writes the Financial Times.

Apple’s Services biz kept overall growth pumping despite a slowdown in hardware sales. The iPhone, iPad and other devices have market penetration and have difficulty unlocking new wholesale markets.

But Google’s search licensing payments to Apple, now likely topping $20 billion per year, have grown considerably and come under the Services umbrella.

The DOJ’s search-focused antitrust suit against Google contends that this deal is illegal, because it’s anticompetitive. If Google loses the case and must cease payments, Apple could lose as much as a quarter of its Services revenue.

In Europe, Apple must already allow third-party app stores and payment alternatives because of the Digital Markets Act.

On the plus side, though, the money that doesn’t make it into Apple’s pocket doesn’t simply disappear. Developers, especially those with thin margins, are anxious to avoid Apple’s 30% commission fee. And subscription-based apps would love to sideload into an iPhone and function properly (and legitimately) without having to shell out 30%.

Apple’s losses will chiefly benefit developers.

Stream It To Believe It

Tired of hearing about the streaming wars?

Well, too bad, because there are more ad-supported streaming services with sizable user bases than ever, Digiday reports.

Netflix and Disney+ spent the past year competing for ad-supported sign-ups, while Amazon’s Prime Video is set to enter the AVOD arena this month.

The competition for ad dollars is now hitting a fever pitch, which agencies say stratifies the ad-supported food chain ahead of this year’s upfronts.

Most buyers opt for Hulu, because it’s got scale. Hulu has been serving CTV ads since 2008. Prime Video, which will soon show ads by default unless subscribers pay not to see them, will also be a must on many media plans. Next up are Netflix and Paramount+ for their premium content libraries, according to media buyers.

But their relative statuses are in constant flux.

Netflix is growing its AVOD subscriber base and has a healthier balance sheet than its rivals, whereas Paramount+ is panicky and supposedly seeking a merger.

In the midst of this streaming shakeout, agencies will have to decide where to spend their ad budgets based on measurement and targeting capabilities and cost efficiency. Godspeed.

Promoting Diversity

Since 2020, ad agencies have invested more in recruiting talent among people with backgrounds that were traditionally underrepresented in marketing.

Some of those programs have yielded tangible results in changing the demographic makeup of agency workforces, particularly as many have focused on hiring efforts.

Other efforts have focused on mentorship. Ogilvy, for example, increased its investment in DEI programs by 36% YOY in 2023, including a program geared toward retaining and elevating Black men within its ranks. While 10% of program participants were given new projects, another 10% were promoted and 20% have received speaking opportunities.

But a large number of agencies still fall short when it comes to elevating diverse talent to leadership positions or providing mentorship that yields a path to promotion, Ad Age reports.

Although mentorship and education are crucial, agencies often have trouble freeing up talent to serve as instructors, and it can be a hard sell to create positions exclusively for education purposes.

Plus, some of these programs risk being moved to the back burner amid a recent pushback against DEI initiatives. There’s clearly a lot of work that still needs to be done.

But Wait, There’s More!

Will 2024 mark the end of the ‘digital agency’? [The Wall Street Journal]

Why Google could wind up paying billions to US publishers in the next year. [Adweek]

The new streaming wars: Netflix versus everyone else. [Financial Times]

A year in the trenches of indie game marketing. [Reddit]

Trends to expect in media and ad tech throughout 2024, according to 80 ad execs. [Ad Age]