Has anyone gotten kicked off a shared Netflix account yet?

I’ll admit it, I’m a moocher, and despite Netflix’s recent threats against anti-password sharing in the US, I’m still safely watching “Extraordinary Attorney Woo” and “Is It Cake?” every week using my aunt’s login.

Is Netflix all bark and no bite? I turned to Reddit to find the answer. Supposedly, Netflix is serious about rejecting account sharing, and not all subscribers are willing to stick around for it.

According to recent research from Samba TV and HarrisX, 52% of Gen Z and 51% of millennials say they’ll cancel their Netflix subscriptions if they can’t share their accounts with people they don’t live with.

Love is money

Once upon a time, Netflix said “love is sharing a password.” Now that the streaming business is rife with competition, the company switched its stance.

These days, streaming services need to generate as much revenue as possible to pitch themselves as profitable to investors. From a business perspective, maximizing subscriber revenue by disallowing account sharing makes sense.

But the backlash from subscribers might be more than Netflix bargained for.

Nobody likes suddenly getting less value for the same price (hey, inflation), so Netflix expects some people to cancel their subscriptions in response. The company doesn’t believe the reaction will be any more extreme than the churn it sees following a price increase.

But subscribers are still annoyed about other recent price hikes, so, at this point, they feel ripped off.

“I had the same feeling of Netflix nickel-and-diming me as I did with every [recent] price hike for less and less content,” says one Redditor in this thread of subscribers who are at the end of their rope.

If Netflix is going to charge higher prices and/or limit account sharing, there needs to be a fair value exchange with fresh content. But according to Redditors, Netflix isn’t pushing out enough hits to make these money grabs worthwhile.

Whether you call that the truth or a way of expressing frustration, subscribers aren’t impressed.

Taking inventory

But not everyone is turning away from Netflix, of course. Some people are just downgrading their plans.

Currently, Netflix’s premium plan ($19.99 per month) supports four concurrent streams per account, while the standard plan ($15.49 per month) allows for two. But if people can’t share their accounts with anyone outside the household, then the need for concurrent viewing diminishes. Why pay for simultaneous account access if you aren’t sharing your account?

People can pay an additional $7.99 per month to keep sharing their accounts. If not, then subscribers can downgrade their plans to stop paying extra for concurrent viewing.

In my opinion, paying over $20 per month for any one streaming service is too much, and I wouldn’t bet on my aunt paying extra so I can keep watching reruns of “Is It Cake?”

Those who downgrade have two options: the basic plan for $9.99 per month or basic with ads for $6.99 per month.

Netflix is hoping to funnel more people into the ad-supported option, including new subscribers who create their own accounts after getting kicked off a shared one. When the day comes, I’m considering getting my own account, and I probably would go for ads simply because I’m cheap.

Pushing for ads

Netflix is under intense pressure from advertisers to get more subscribers signed up for its ad-supported offering. Advertisers have been paying premiums to reach Netflix audiences, but the streamer’s AVOD audience has been growing more slowly than the competition. Netflix is hoping anti-password sharing is the solution.

Subscribers don’t often make changes to their membership plans (Netflix acknowledges this), so when they do, they’re likely looking for as little change as possible. For longtime Netflix users, that means no ads.

Plus, Netflix subscribers are currently fed up with anti-password sharing on top of steady price increases, which is why some users say they’re gone for good. Being asked to also tolerate ads might be too much. And if people aren’t signing up for ads, that means lower average revenue per user for Netflix.

The entertainment giant says it’s ready for the initial backlash, but it doesn’t appear ready to fully acknowledge this potential reality.

Why do I say this?

Anti-account sharing is not an option users can select as a reason for why they’re canceling their subscriptions. Maybe Netflix isn’t ready for the truth.

📣 ALSO: You can catch me at the Cynopsis Measurement & Data Conference in New York next week. I’ll be moderating a panel about CTV measurement on Tuesday, June 13. Check out the agenda here. AdExchanger readers get a 25% discount on registration with the code ADEXCH25.

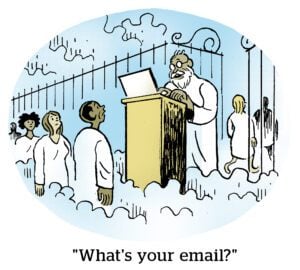

Let me know what you think. Hit me up at [email protected].