The TV measurement aisle is due for a cleanup.

And NBCUniversal is sending a mop in the form of a new “Currency Council,” the company announced during a press conference in New York City on Wednesday.

“Streaming has a severe undercounting problem that’s disadvantaging digital television,” Kelly Abcarian, NBCU’s EVP of measurement and impact, told AdExchanger following the event.

NBCU’s Currency Council features a list of marketers who have committed to using alternate measurement currencies for at least a portion of their ad spend with NBCU. The program currently has about a dozen buy-side partners, including State Farm, Wayfair and T-Mobile.

The Currency Council follows the certified measurement program NBCU kicked off last year with iSpot as the first official partner for national TV measurement.

Alternative currencies will enable the TV industry to finally wrangle frequency capping and ad wastage on campaigns, Abcarian said.

State of measurement

Council or no council, TV ad measurement is no easy task.

NBCU has been vetting providers for its new measurement framework since last year, when it began an RFP process for the certified measurement program.

Since the iSpot announcement, NBCU has certified eight other measurement providers, including Conviva for streaming, Comscore for local TV, plus six partners doing ad verification, including Oracle’s Moat and Integral Ad Science.

More additions to that list will be announced at NBCU’s One23 conference on February 16, when the company will share updates on One Platform, which is NBCU’s cross-channel ad measurement stack, said Krishan Bhatia, chief business officer of NBCU’s global ads biz, at Wednesday’s event. (NBCU One Platform is not to be confused with Nielsen ONE, Nielsen’s cross-channel TV and video ad ratings product, which is currently in beta.)

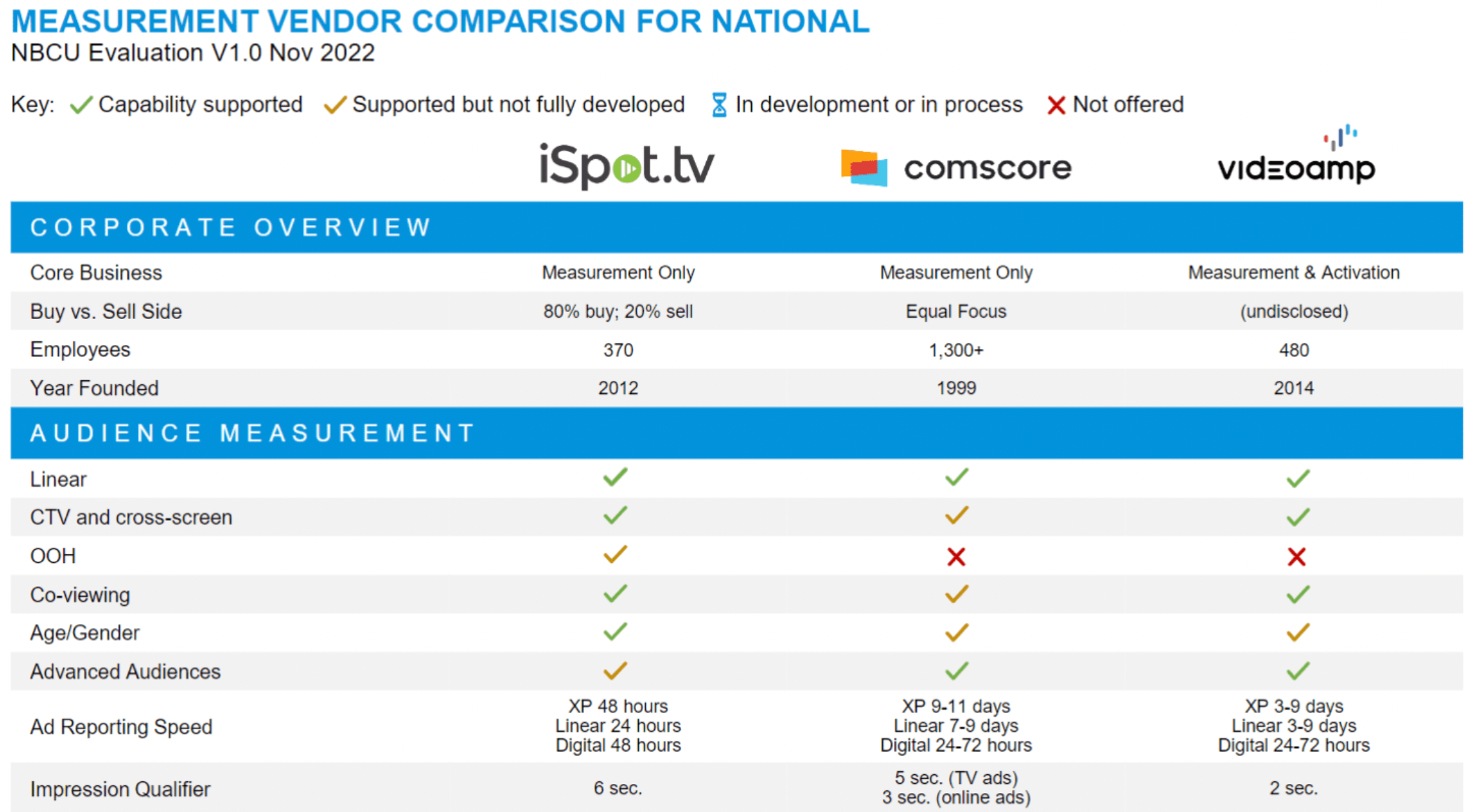

Until next year, the media giant is keeping close tabs on some of the top currency contenders, namely iSpot, VideoAmp and Comscore.

Broadcasters have been cultivating partnerships with multiple measurement sources to avoid another Nielsen-like monopoly, so NBCU isn’t giving exclusive rights or settling on one winner for its measurement framework.

Compared with iSpot, for example, NBCU ranked VideoAmp higher for its planning tools, data clean room environment, advanced audiences and advanced audience guarantees.

NBCU also supports Comscore’s advanced audiences, while NBCU’s chart ranks iSpot’s as “supported but not fully developed.”

The next step for TV measurement, Abcarian said, is to get more advertisers to transact against alternate currencies.

Last year, 40% of NBCU’s upfront deals were a part of the company’s alt currency “test and learn,” Abcarian said, which is a “huge testament of [the industry’s] enthusiasm to solve measurement.”

Data dig

Giving ad measurement a makeover means NBCU must get its mitts on as much data as possible.

Identity data will be the mechanism to create scaled TV measurement, said John Lee, NBCU’s chief data officer.

And on the data collection front, NBCU launched the first-party data platform NBCUnified in January with 150 million IDs. The company now boasts 200 million unique IDs across 90 million households.

With those IDs, advertisers can match their own first-party data to NBCU audience and subscriber data in a data clean room. That means targeting and analytics on NBCU content should improve, especially for data-savvy brands.

The first client to try out the solution was General Motors earlier this year.

Clean rooms are the industry’s new buzz word, Abcarian said, because data is moot without the right infrastructure to support scale and privacy standards.

Data interoperability through clean rooms will be integral to reaching a multicurrency future, she said.

Programmatic prelude

One straightforward way to scale alternative TV measurement is to make more inventory available programmatically.

NBCU is especially focused on plugging programmatic pipes into its streaming inventory, which comes primarily from Peacock.

In March, NBCU announced Peacock AX (Audience Extension), a tool that consolidates NBCU’s full streaming footprint (including NBC Sports) to make inventory available for programmatic buyers.

Now, NBCU will support private marketplace buys for Peacock and the rest of its streaming media, including “biddable live environments” for live sports, said Ryan McConville, EVP of ad platforms.

NBCU also certified a total of 11 third-party DSPs for programmatic streaming buys, including Tremor’s Amobee, Roku OneView and The Trade Desk.

Still, speaking of interoperability, advertisers want to apply their nifty new media buys across other media distributors, not just NBCU, McConville said.

As of this year, for example, advertisers using NBCUnified IDs can also push their data set over to OpenAP for a “cross-industry report.” They can’t target IDs across media owners, but there will be analytics for whether NBCU audiences are targeted across other networks. OpenAP is a TV advertising data company co-owned by NBCU, Fox, Paramount, Warner Bros. Discovery and Snowflake, the data clean room and cloud data company, which invested in OpenAP last month.

NBCU’s goal is to make it easier for advertisers to buy TV ads programmatically, because that’s how the industry can “democratize access to premium video for marketers of all sizes,” McConville said.

But, as long as the TV industry relies on “yesterday’s measurement,” Abcarian said, the potential of streaming media cannot be “fully realized by advertisers.”