It’s nice to see that AI rivals Microsoft and Google can agree on something.

Both Microsoft and GV (formerly Google Ventures), an Alphabet-backed venture firm, are investors in an enterprise-focused generative AI company called Typeface, which launched on Monday with $65 million in Series A funding. Venture capital firm Lightspeed also participated.

Generative AI is a happening topic right now.

But large B2B and B2C companies are struggling to figure out how to adopt the technology in their day-to-day business and workflows, said Abhay Parasnis, CEO and founder of Typeface and Adobe’s former chief technology and product officer.

Companies are excited by the promise of generative AI to produce more content faster and cheaper, he said, but they want content that’s unique to their audiences and brand.

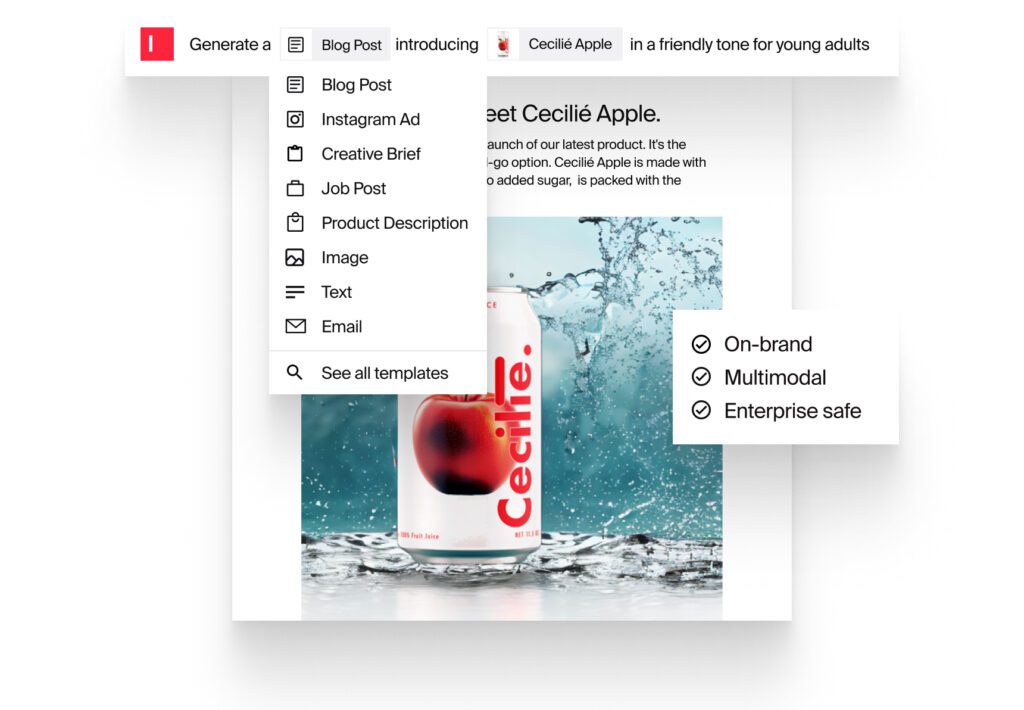

Typeface has an AI platform called Blend that trains on client-supplied assets, such as existing images, webpage content and Google and Meta ads. The custom creative that comes out “precisely preserves fonts, logos, colors and texts” in images and brand voice in social posts, press releases, job postings and ad copy, Parasnis said.

True to its name, Blend generates texts and images by pulling from both the client’s internal content and from big, publicly available AI models, such as ChatGPT. Over time, Typeface will add other assets, including video and animation.

Similar to how business intelligence platforms like Tableau, Notion and Airtable make it easier to visualize and understand data, Typeface allows companies to rapidly create content templates and workflows with a low- or no-code engine.

The power of micropersonalization

Coming from Adobe, Parasnis knows firsthand that creative content tools like Photoshop “still require a pretty sophisticated skill set” and a steep learning curve.

Generative AI, by contrast, is so easy to use that it has the potential to usher in a new level of personalization, Parasnis said.

For instance, marketers could create multiple versions of a website homepage, each tailored to a different audience, with additional optimization for each customer who visits the site.

Or advertisers could more easily create different content for very specific microsegments.

Eventually, what ad platforms and companies learn from the performance of their ad buys could drive the creation of subsequent AI-generated content.

As the competition heats up to create the best generative AI, Typeface wants to be one of the “large players” in the space, Parasnis said.

The leadership team is in place, with alumni from the likes of Microsoft, Adobe, Twitter, LinkedIn and Meta. Now Typeface’s focus will be continuing to scale as it goes to market.

“This is an exciting space,” Parasnis said. “Every day, there is something new happening.”