Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Snap Decision

All sorts of non-advertising companies have recently launched ad businesses – and vice versa.

Companies that rely heavily on ad revenue, including Meta, Twitter and Snap, want to diversify their one-pillar businesses.

But diversifying an ad business is much harder than the slippery slope into data and media sales.

Although Snap’s subscription product, Snapchat+, recently passed 5 million subscribers, other diversification efforts aren’t going as well.

Earlier this year, Snap launched a business unit called ARES to sell AR tech to other businesses, mainly to retailers planning to use it for simulating clothes or a virtual makeup try-on. And, well, Snap has already shut ARES down, Bloomberg reports.

Snap still has Camera Kit, a developer product for other apps to incorporate AI, and CEO Evan Spiegel said in a memo that the company won’t rethink its “willingness to take risks and try new things.”

Still, Snap Spectacles, its video streaming sunglasses, went largely unsold and cost the company a pretty penny in 2017. Investing in newness isn’t easy.

As Spiegel notes in his memo: “Our business performance has reduced our capacity to invest in this incremental opportunity, as we have had to focus our resources on our core advertising business.”

A New Take On ATT

Many companies have pointed to Apple’s ATT policy as an excuse for collapsing revenue. Not surprising considering that ATT requires all non-Apple-owned iOS apps to get consent before collecting data or engaging in ad tracking.

But were there any benefits?

It’s hard to quantify the financial upside of an increased focus on privacy – but not impossible.

Three economists from the National Bureau of Economic Research (a nonprofit research group, btw, not a government agency), found that if 10% more people disable tracking, the number of financial fraud complaints drops by roughly 3.21% on average.

On one hand, 3.21% isn’t a huge number and isn’t entirely attributable to ATT protections – similar to how Apple’s privacy changes aren’t fully responsible for the mobile economy’s downturn.

There is also a broader secular trend of privacy and data security improvements unrelated to ATT.

But this data provides a benchmark that privacy advocates can point to as an example of how higher privacy standards can demonstrably prevent financial harm – and not just cause financial harm.

The Advertiser’s Prime

A leaked pitch has revealed more details about Amazon’s plan for ads on Prime Video, Insider reports.

Unsurprisingly, Amazon is pitching advertisers primarily on its shopper-first audience. It brags that 84% of Prime Video households have made a purchase on Amazon in the past month and estimates that a quarter of those households have annual incomes exceeding $150,000.

And, of course, Amazon is also promoting its scale.

When Prime Video ads roll out early next year, Amazon predicts those campaigns will reach more than 115 million households immediately (although customers will be able to avoid ads by paying a monthly premium).

For the time being, Amazon’s video assets are isolated in terms of ad sales. This includes the free ad-supported streaming service Freevee, the upcoming Prime Video CTV ads, Twitch ads, Fire TV, offsite video and even its NFL streaming rights for Thursday Night Football games.

At some point, though, this may all fall into one Amazon channel with reach across both upper-funnel and direct-response audiences.

But Wait, There’s More!

Sephora adds a gamified experience to its loyalty program in an appeal to Gen Z. [Glossy]

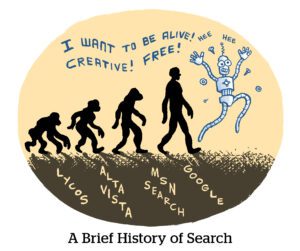

Happy birthday, Google. [Mashable]

OpenAI is looking to raise new investments at a valuation between $80 billion and $90 billion. [WSJ]

The EU criticizes X over the levels of disinformation found on the platform. [The Verge]

Startups squint to read the IPO tea leaves. [The Information]