Smartphone penetration in Asia-Pacific is on the lower end, especially compared to the United States and North America, but it is growing. A new report from Forrester Research predicts that mobile marketing strategies will play a major role in the region in 2015.

Smartphone penetration in Asia-Pacific is on the lower end, especially compared to the United States and North America, but it is growing. A new report from Forrester Research predicts that mobile marketing strategies will play a major role in the region in 2015.

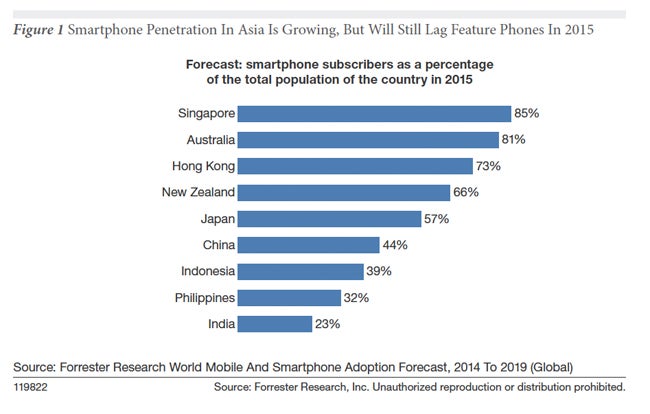

According to Forrester, smartphone penetration across the Asia Pacific region will be at 36% of the entire population in 2015, with Singapore, Australia and Hong Kong leading the way. India will have the lowest penetration, with 23% of the total population subscribing to smartphones in 2015.

“When the percentage reaches the 30s, that means that something has become mass market and it’s no longer a niche solution or technology,” explained Tim Sheedy, principal analyst and the writer of the “Predictions 2015: Mobile Strategies Will Be Critical To Serving Asia Pacific Customers” report. “This is an important barrier to cross because suddenly organizations have to take smartphones seriously. If you are targeting customers in India and China, you might not have taken smartphones seriously before, but you do have to now.”

“When the percentage reaches the 30s, that means that something has become mass market and it’s no longer a niche solution or technology,” explained Tim Sheedy, principal analyst and the writer of the “Predictions 2015: Mobile Strategies Will Be Critical To Serving Asia Pacific Customers” report. “This is an important barrier to cross because suddenly organizations have to take smartphones seriously. If you are targeting customers in India and China, you might not have taken smartphones seriously before, but you do have to now.”

Comparatively, Forrester predicts that 71% of the North American population will be smartphone subscribers in 2015. In early 2013, Forrester reported that North American smartphone penetration was at 47%.

Both Pew and eMarketer are more conservative with their smartphone user information. Pew reports that as of January 2014, 58% of American adults will have smartphones, while eMarketer predicts that 55.4% of the US population will use smartphones in 2015.

The reasons for the lag in smartphone usage in Asia Pacific are well-known: lower income families are not able to afford the more advanced smartphone devices and there is often a lack of 4G service, with 3G service continuing to be spotty throughout the region, according to Forrester.

However you look at these penetration numbers, it’s too difficult to compare the Asia Pacific region to North America when it comes to mobile, Sheedy said. The report highlights the “mobile mind shift” of Asia Pacific consumers, as they often think mobile first, because mobile devices have been their main connection to the Internet. Despite high smartphone penetration in places like Australia and the United States, consumers still look to their laptops or desktops, rather than having a mobile mind shift.

“It is difficult to compare because for many users in Asia, their first ever usage of the Internet was on a feature phone, and you just can’t compare it to other markets, except maybe Africa,” Sheedy told AdExchanger. “There might be some comparisons between the way Europe grew up around feature phones and text messaging services,” but it’s just not the same as the US market.

This mobile first mindset is what companies, marketers and CIOs should be focusing on in Asia Pacific, Sheedy said, not necessarily the penetration numbers. This means that in Asia, mobile marketing consists of not just smartphone apps and mobile web experiences, but also text messaging and figuring out how to reach feature phone users.

“In India and China, there is probably a good chance consumers aren’t running a top-enterprise device, they are not using a screen with the highest resolution possible,” Sheedy said. “Write your app for lower rated processors and lower resolution screens because there’s a chance, even if people download your app, that they won’t be able to use it.”

In the report, Forrester also encourages CIOs and companies to look at creating disconnected apps that draw more from core device capabilities, rather than fast connectivity, to get around the lack of 3G and 4G service in some areas.

“In 2015, less than 5% of most businesses’ marketing spending will go toward the mobile space, despite mobile commanding a higher percentage of customers’ attention,” the report said of the Asia Pacific region. If marketers in Asia Pacific want to work on a variety of mobile marketing strategies to reach this diverse mobile audience, that number will need to increase soon.

“Mobile marketing spend isn’t that high, but in terms of the percentage of the marketer’s mind and if they are thinking about mobile, mobile is the big challenge of 2015,” Sheedy said. “In 2015, mobile is that top priority. How do we target customer effectively on mobile platforms and mobile devices? And then in 2016, we’ll see that spend really start to take off.”